MiFID II

- Reporting

- Microsecond time stamping

- Person responsible

- Showing costs

- Recording the market venue

- Recording agency or principal

- Legal entity identifiers (LEIs)

- Client appropriateness

- Client segmentation

- Systematic internalisation

Reporting

All financial institutions are now required to report trades in investment products via an approved publication arrangement (APA).

- When trading via a multilateral trading facility (MTF), the MTF will handle the reporting of all transactions.

- When not trading via an MTF, sellers are obliged to report their transactions.

- There are a total of 65 data fields that may need to be reported after a transaction.

- Most transactions must be reported immediately, but deals classed as large in scale (LIS) can be delayed.

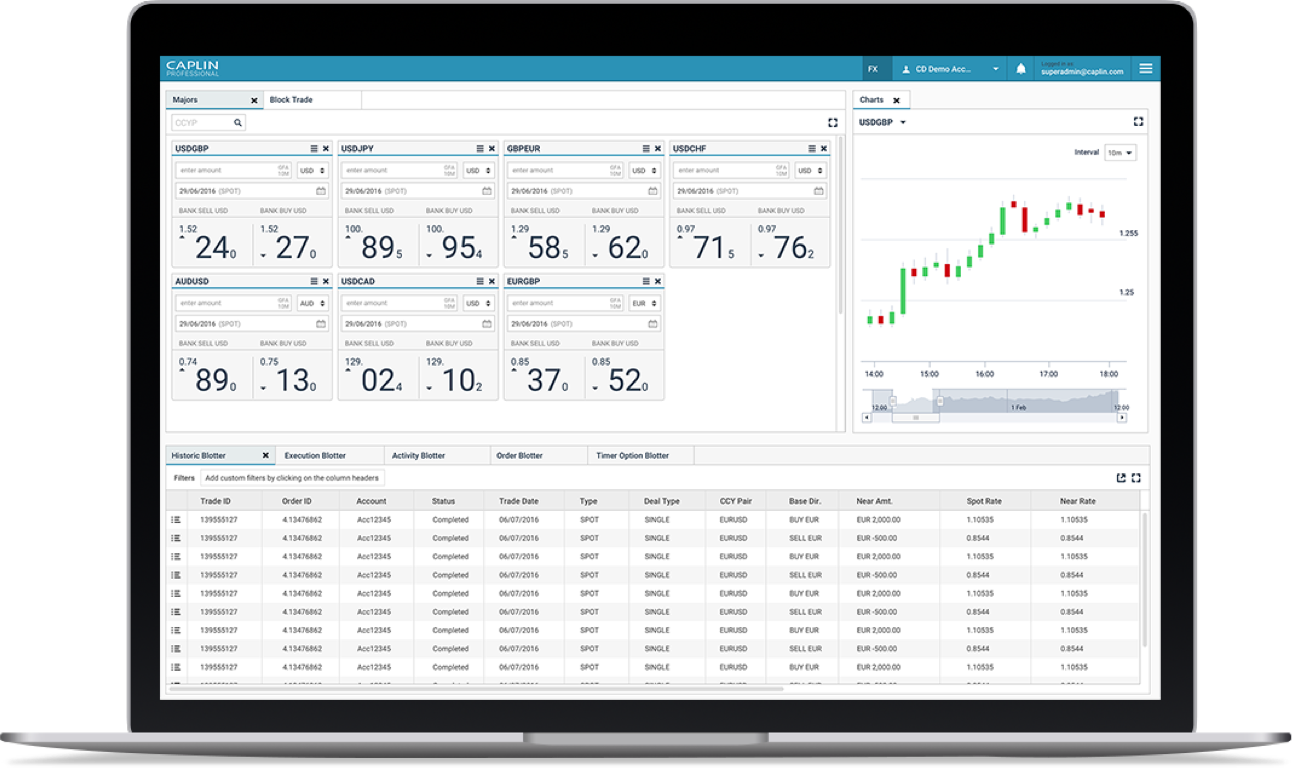

- Caplin's products track all these fields and make them simple to report via a relevant APA.

Microsecond time stamping

To help regulators determine the order of events during periods of high market-volatility, there are greater regulatory requirements for clock accuracy and timestamp precision.

- Business clocks must be synchronised to UTC.

- Timestamps must be recorded to a higher precision than previously required.

- High-frequency trades must be recorded with timestamps of microsecond precision from a clock synchronised to within 100 microseconds of UTC.

- Electronic trades must be recorded with timestamps of millisecond precision from a clock synchronised to within 1 millisecond of UTC.

- Voice trades must be recorded with timestamps of second precision from a clock synchronised to within 1 second of UTC.

- Caplin Platform event log entries are time stamped with microsecond precision, aligning with the most exacting requirements of MiFID II.

Person responsible

It is now essential to record who is responsible for price quotes, orders and transactions on your platform.

- Every actor in the process is recorded: your client, the specific clerk, the sales trader and all authorisers of the trade.

- Caplin's corporate 4-eyes workflow ensures that all trades are approved by at least two authorised parties.

Showing costs

Whether displaying the mid-rate, or the cost of a transaction, we can help you to be transparent with your clients about the cost of their transactions.

- Estimated cost ex-ante

- Confirmed cost ex-post

- Sales traders can lock their cost (allowing the client's rate to float)

- Sales traders can lock the client's rate (allowing the bank's costs to float)

Record the market venues

To provide evidence of best execution practices, the venue that trades are executed on should be recorded, as should whether the trade was done on an agency or principal basis.

Legal entity identifiers

It is now a legal requirement that all clients who trade in investment products have a legal entity identifier (LEI). Customers without LEIs can continue to make payments and trade other non-speculative products.

- Caplin's permissioning and entitlements functionality ensures that your clients trade in only the products that they are legally entitled to trade and help your sales traders understand their clients' limits.

Trades entered manually

MiFID's requirements for providing and recording a reference price apply as equally to manually-entered trades and they do to automatically-entered trades made as part of straight through processing.

- Caplin can act as a single gateway through which all your trades are handled, ensuring that all trades are reported appropriately.