Section 5 - NDF Tiles

NDF tiles are used to execute non-deliverable forwards.

What is an NDF?

A non-deliverable forward (NDF) is a derivative of the FX Forward market and is a type of contract for difference (CFD). It is used to hedge exposure to a currency in which trading in outright forwards is prohibited due to regulatory restrictions.

In an FX outright forward, the traded currency is delivered whereas with an NDF only a cash settlement is made. The cash settlement is calculated as the difference between an agreed upon exchange rate — an NDF rate — and the prevailing spot rate at a future date, for a notional amount of the currency. The future date is termed the fixing date, and the date of delivery of the cash settlement is termed the settlement date.

Setting an NDF on a tile

In the FX Professional web app, a user would be allowed to do a spot trade on USDINR — US Dollar (USD) against Indian Rupee (INR) — but would not be allowed to trade forwards due to regulatory restrictions. Using an NDF Tile, a user may execute an NDF as a type of forward contract on USDINR.

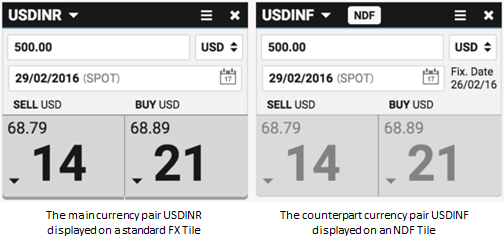

A user will need to subscribe to an NDF currency pair in order to launch an NDF Tile, these are known as counterpart currencies. USDINR is displayed on a standard FX Tile as the main currency pair, whereas on an NDF Tile the counterpart currency pair for USDINR is displayed as USDINF. The counterpart currency USDINF indicates that USDINR is NDF enabled, allowing you to submit an NDF trade.

By subscribing to a counterpart currency pair such as USDINF, you can launch an NDF Tile and submit an NDF for a USDINR:

As you can see, the NDF Tile is the same as the standard FX Tile except for the Fixing Date and NDF Indicator. In addition, spot trading is disabled on an NDF Tile. NDF currency pairs such as USDINF will typically have a different list of tradeable forward tenors to their deliverable counterpart (USDINR).

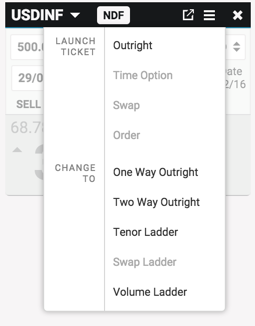

Alongside tile support for NDF, FX Professional also supports NDF Ticket trading using RFS Tickets. NDF Tiles do not support Time Options, Swaps, Swap Ladder or Orders. As such, these features are disabled in the NDF Tile menu:

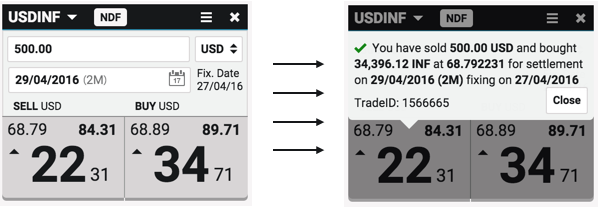

Executing an NDF trade

The process of trading with an NDF Tile is the same as with an FX Tile:

NDF implementation

NDF Tiles are effectively the same as standard FX tiles, except for the following differences:

How a tile identifies an NDF currency pair

When determining whether a currency pair is NDF enabled, the currency pair’s TenorDates record is checked. For NDF-enabled currency pairs, the TenorDate record includes a FixingDates field where a list of values is returned, and the value of the ForwardType field is "NDF" as opposed to "STANDARD":

| Field | Value |

|---|---|

ForwardType |

NDF |

Tenor |

"TODAY":"20160121","SPOT":"20160125","1W":"20160201","1M":"20160225",… |

FixingDates |

"TODAY":"20160122","SPOT":"20160122","1W":"20160128","1M":"20160223",… |

| SPOT date and Short Tenor dates are included in the TenorDates record, even though it is not possible to trade NDFs on them. This is due to internal processes in the way that back-end systems handle trade dates. Any request for prices on these tenors should not return any prices. |

Trading an NDF

When trading an NDF, the Submit message is submitted with all the standard fields except the value for the TradingType field is set to "NDF" as opposed to "FWD".

| Field | Value |

|---|---|

TradingType |

NDF |

FX Tiles Documentation: