Sales Intervention User-Interface

FX Sales provides sales traders with a rich user interface for monitoring automatic pricing and intervening with a manual price when required.

Blotters

The Sales Intervention screen includes two blotters:

Active Deals Blotter

The Active Deals Blotter is the interface through which sales traders monitor all active deals in the system.

The Active Deals Blotter displays the following deals:

-

Deals that are being priced automatically

-

Deals that are waiting to be priced

-

Deals that are under review by sales traders

-

Deals that are being priced by sales traders

-

Deals that have just been completed

Deals that have completed are removed from the Active Deals Blotter five seconds after completion.

All trades pass through the Active Deals Blotter, including ESP trades. ESP trades are removed from the Active Deals Blotter five seconds after completion.

Historic Deals Blotter

The Historic Deals Blotter displays all trades that are in a terminal state:

-

Completed trades

-

Cancelled trades

-

Rejected trades

-

Expired trades

You can launch confirmation tickets from all tickets in the Historic Blotter.

Tickets

FX Sales provides tickets for intervening in the pricing of six product types.

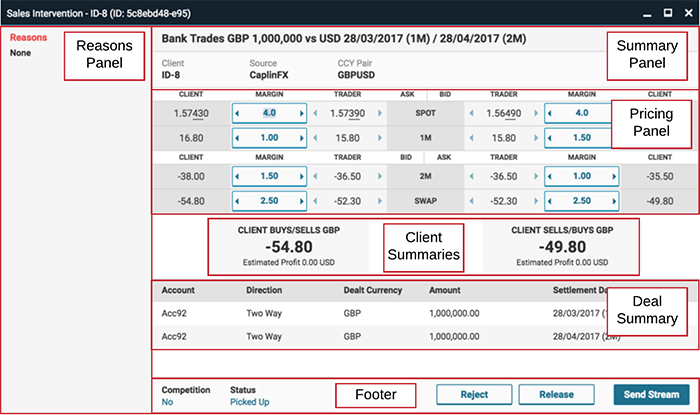

All tickets share a common layout:

Ticket panels:

-

Reasons Panel: displays risk analysis results and warnings

-

Summary Panel: high-level details of the trade, including a natural language summary

-

Pricing Panels: provides the interface for adjusting the margin and the trader rate

-

Client Summaries: the rates that will be displayed on the client’s ticket and the estimated profit if the trade is executed at those rates

-

Deal Summary: the specific details of the trade, including the amount, direction, account, and settlement dates.

-

Footer: buttons for rejecting, releasing, and sending the quote

There are six different interfaces, depending on the type of product traded:

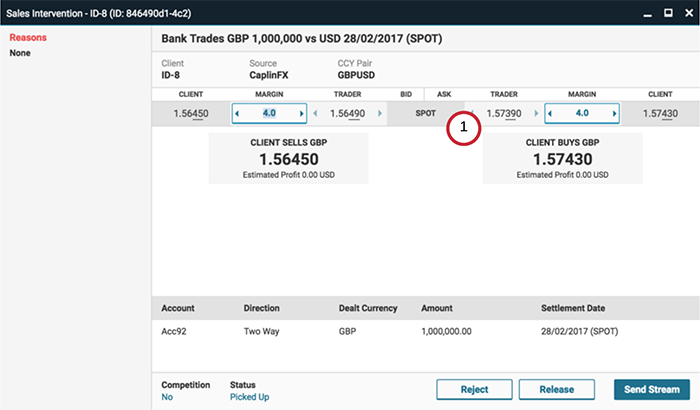

Spot ticket

The spot ticket is illustrated below:

The spot ticket’s pricing panel consists of a single row (1).

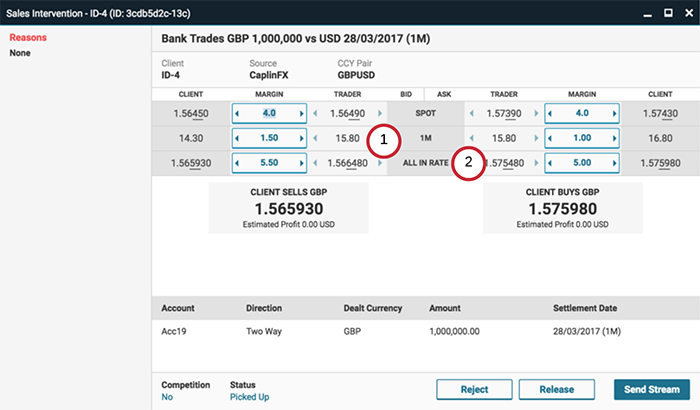

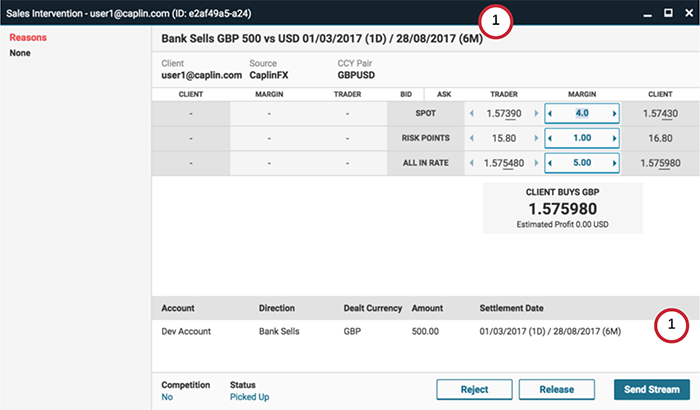

Forward ticket

The forward ticket is illustrated below:

The forward ticket is similar to the spot ticket, but includes two extra rows in the pricing panel:

-

A forward row (1), which displays the core points and a margin.

-

An All-In Rate row (2), which displays the sum of the spot rate and forward points.

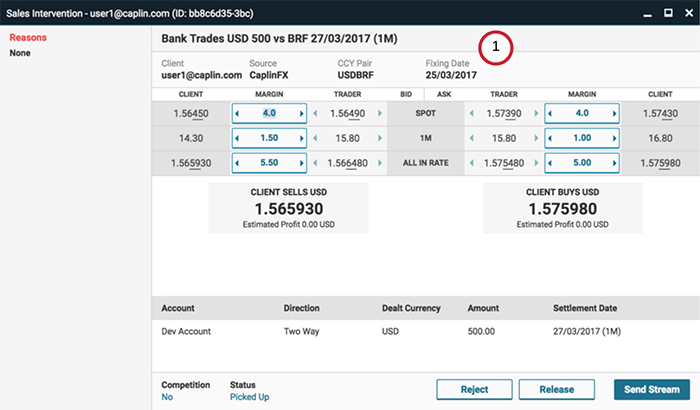

Non-deliverable forward ticket

The non-deliverable forward ticket is illustrated below:

The non-deliverable forward ticket is similar to the forward ticket, but includes a Fixing Date field (1).

Flexible forward (time-option forward) ticket

The flexible-forward ticket is illustrated below:

The flexible-forward ticket is similar to the forward ticket but has a date-range (1) in place of a single settlement date.

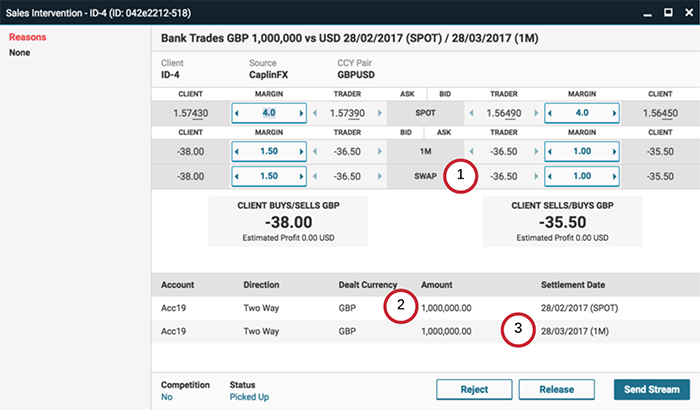

Swap ticket

The swap ticket has two variations: a spot-forward swap ticket and a forward-forward swap ticket.

The spot-forward swap ticket is illustrated below:

The Deal Summary displays the direction and settlement dates for the near leg (2) and far leg (3) of the swap.

The Pricing Panel displays the swap points (1), as does the Client Summary.

The forward-forward swap ticket is identical to the spot-forward swap ticket, except for the inclusion of an extra forward row in the near leg of the Pricing Panel.

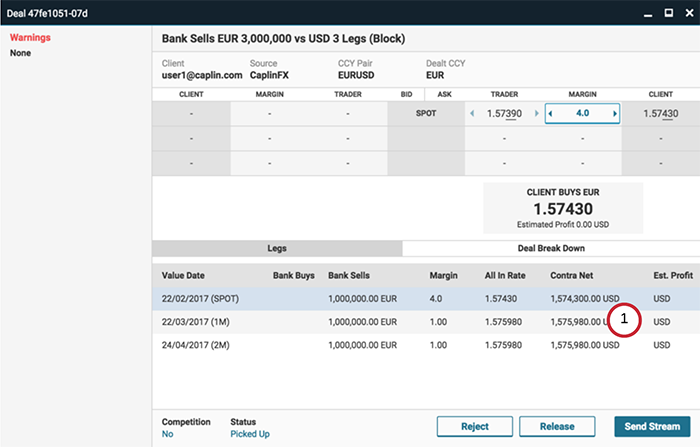

Block-trade ticket

The block trade ticket is illustrated below:

The block trade ticket has a different Deals Panel (1) to the other tickets. The panel comprises two tabs: Legs and Deal Breakdown.

When the Legs tab is selected (as above), the Deals Panel displays the deals in the block trade netted by tenor. Clicking a netted row in the panel populates the Pricing Panel for that tenor, and allows the sales trader to change the rate and margin for all deals under that tenor.

When the Deal Breakdown tab is selected, the Deals Panel displays the constituent deals for the selected row in the Deals Panel. The breakdown includes the account under which each constituent deal is placed, which can be important when assessing credit risk.

Actions

You can perform the following actions with a Sales Intervention ticket:

Send a stream of quotes to the client

By default the ticket is provisioned with a streaming trader rate. To send a streaming rate to the client:

-

Review the risk analysis report

-

Review and adjust margins to offset the bank’s exposure to risk

-

Click Send Stream

Send a single quote to the client

To send a single quote to the client:

-

Review the risk analysis report

-

Click the trader rate. The trader rate will stop streaming and allow you to adjust it to a fixed value.

-

To refresh the Trader Rate field with the prevailing trader rate, click Refresh beneath the Trader Rate field

-

To return to a streaming trader rate, click Return to Stream in the ticket’s footer.

-

-

Review and adjust the Trader Rate and margins to offset the bank’s exposure to risk

-

Click Send Quote

Withdraw an existing quote

To withdraw a live quote with a client, click Withdraw. The ticket will return to pricing mode, and you can then perform one of the following actions:

Release the ticket

To release the ticket for other sales traders to pickup, click Release.

Reject the ticket

To reject the ticket (and the quote request it represents), click Reject.

See also: